Building the Financial Homepage: From Transactions to Daily Money Hub

Executive Summary

The Impact:

Created a new, high-traffic main menu surface.

Support queries on balances/rewards reduced.

Daily engagement grew as customers started opening the app without an immediate purchase in mind.

Established the strategic foundation for Zilch’s super-app positioning.

ZILCH CUSTOMER FIRST AWARD - Voted for by peers and leadership

Proposed and launched Zilch’s first-ever Financial Homepage as a new main menu item — transforming the app from transactional BNPL to a daily financial hub.

12% reduction in support queries (balance & rewards)

+9% increase in DAU

+14% increase in rewards redemption

+7% improvement in retention (M1→M2)

Created a new strategic surface that positioned Zilch as a financial super-app in the making, strengthening customer trust, engagement, and investor narrative.

The Pitch:

I proposed to the business a Financial Homepage — a brand-new main menu entry point in the app — designed to be the customer’s first stop for balance, rewards, and financial insights, product marketing, changing spending specifications, card access and more in the long term future.

Why the agreed agreed:

It was a strategic leap. Zilch had no central homepage; customers bounced in for a transaction and left. The homepage positioned Zilch as a daily financial companion, driving retention, subsidy growth, and long-term differentiation.

Customer Demand:

Customers consistently asked: “What’s my balance? What rewards have I earned? How am I spending?” These questions revealed a gap in trust and clarity that only a new entry point could solve.

The Long-Term Plan:

Shift from transactional BNPL app → to a financial super-app, where customers return daily for budgeting, insights, and premium services.

Context & Problem

The State Before:

Zilch had no homepage. Customers jumped directly into credit and retailer flows.

The app was seen as a means to an end — useful only when buying something.

Customers lacked visibility into rewards, balances, and spend.

High support query volume: “Where’s my balance?”, “How much have I saved?”

The Business Risk:

Low daily engagement → customers used Zilch only when needed.

Weak retention → voluntary churn after first purchase cycle.

IPO story risk → no proof of becoming part of daily customer life.

“It doesn’t feel like my money app — just a way to buy something.”

Vision & Strategy

Guiding principles behind homepage design

The North Star:

Create Zilch’s first-ever Financial Homepage — the anchor for daily engagement, trust, and long-term financial wellbeing.

The Pitch:

Customer Value: Answer the top 3 recurring questions upfront (balance, rewards, spend).

Business Value: Drive frequency and retention by making Zilch a daily-open app.

Investor Value: Position Zilch as a financial platform, not just a BNPL provider.

Strategic Anchors:

Visibility — customers see balance, rewards, and spend at a glance.

Engagement — nudges to return daily, not just when buying.

Expansion — a surface to layer future features (budgeting, insights, premium).

Execution & Leadership

CEO Sponsorship:

Secured buy-in by framing homepage as a strategic shift — not a feature, but a new platform surface.

Cross-Functional Leadership:

Compliance → embedded FCA transparency from day one.

Marketing → surfaced rewards/offers in a way customers understood.

Product → defined homepage as a permanent nav anchor, not an experiment.

MVP Priorities (Customer-Led):

Show available balance clearly.

Display rewards earned/saved.

Upcoming instalments to be paid.

Credit limit availability.

Access card details.

Allow customers to switch between Pay now and Pay over 6 weeks as default (business led).

Business Impact Timeline

Pitch (Month 0)

Proposed homepage to CEO as new nav item.

Secured immediate sponsorship.

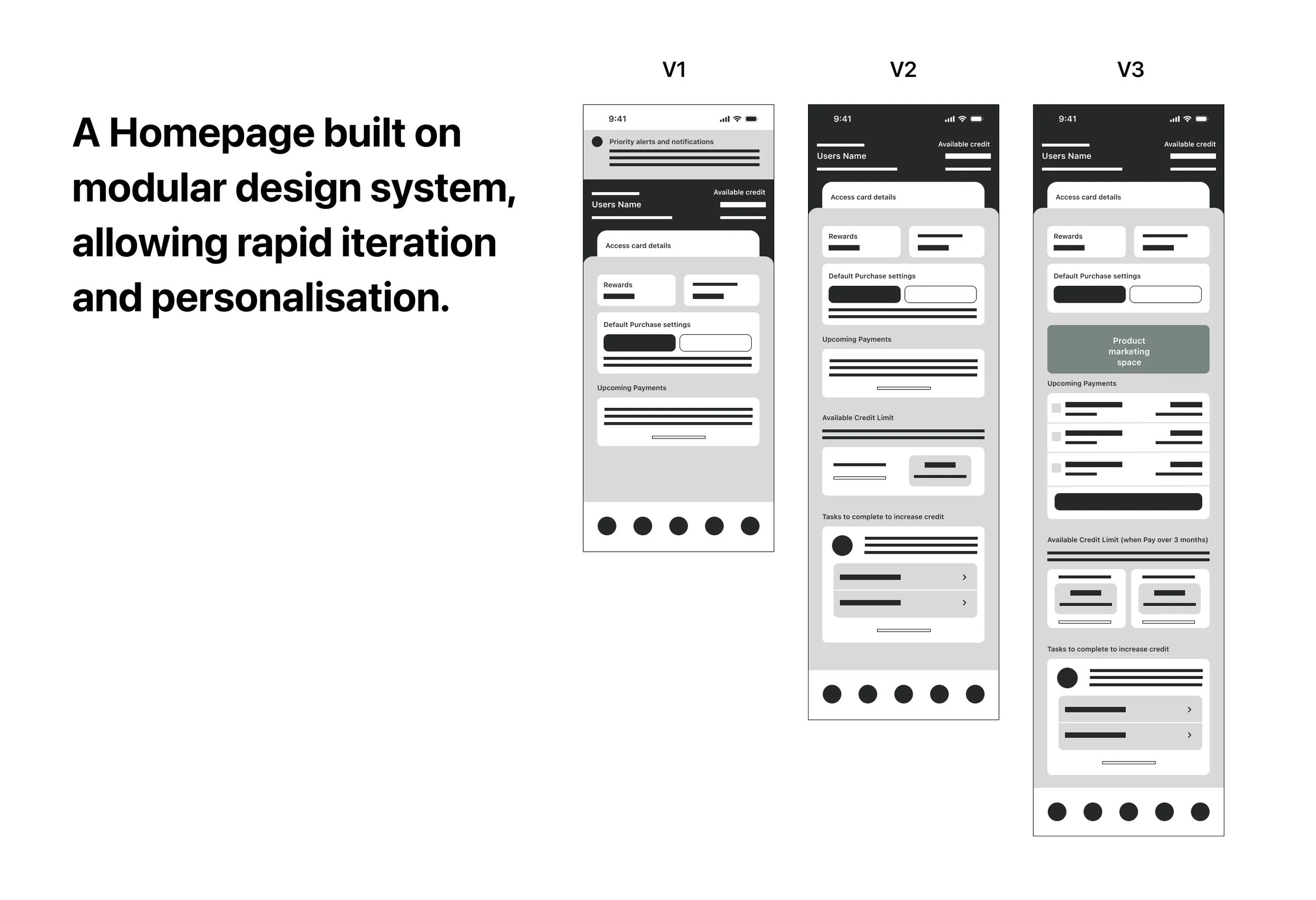

Foundation (Months 1–3)

Designed MVP focused on clarity (balance, rewards, spend).

Cross-functional alignment.

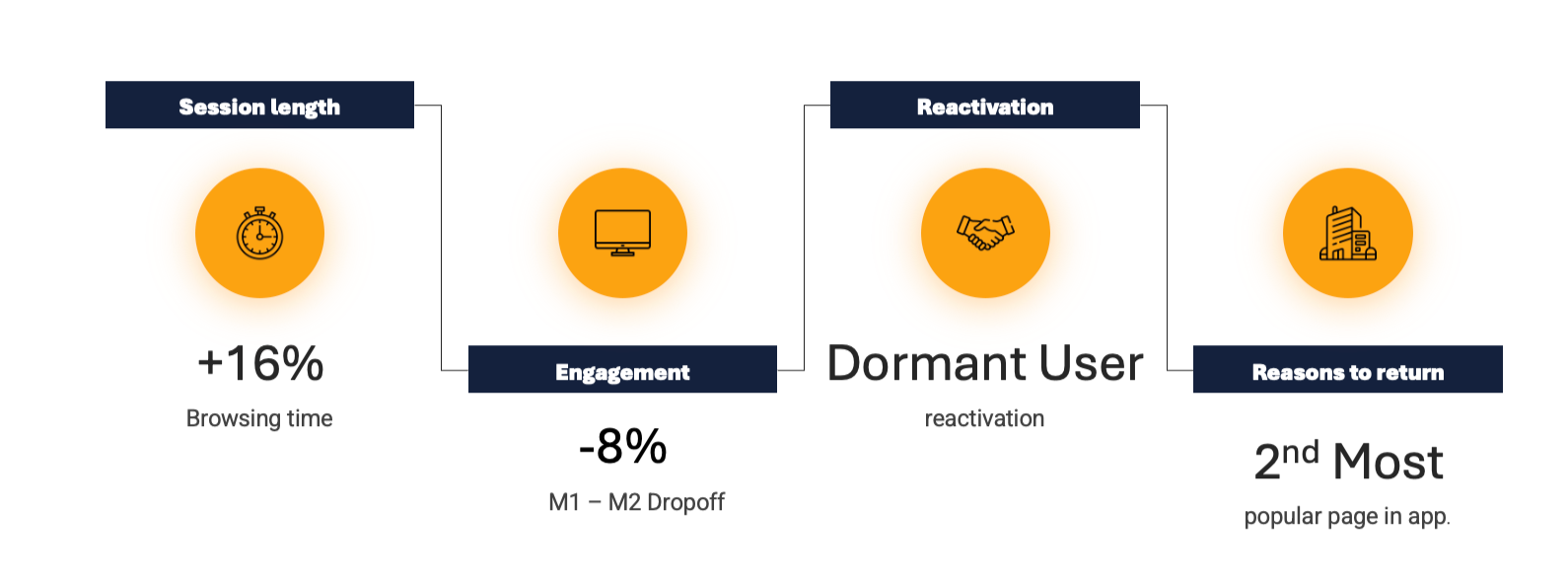

Pilot (Months 4–6)

Launched Zilch’s first homepage.

Impact: Support queries ↓ 12%, DAUs ↑ 9%.

Expansion (Months 7–12)

Added spend insights and nudges.

Rewards redemption ↑ 14%.

Retention (M1→M2) improved by 7%.

Scale (12+ Months)

Positioned homepage as hub for financial wellness, AI nudges, premium services.

Results & Outcomes

Customer Impact:

Greater trust through transparency.

Reduced frustration: balance and rewards questions answered instantly.

Customers opened app without a purchase in mind.

Business Impact:

Support queries ↓ 12%

DAUs ↑ 9%

Rewards redemption ↑ 14%

Retention (M1→M2) ↑ 7%

New surface area created for long-term revenue streams.

Leadership Lessons & Insights

Create the Surface First: Sometimes strategic design isn’t about optimising flows, it’s about inventing the missing anchor.

Speak business Language: It was backed because it was framed as a retention tool, not a design exercise.

Solve Customer Anxieties: Customers’ top questions became the homepage pillars.

Design for Expansion: From day one, the homepage was pitched as a platform, not just an MVP.

Future Vision

6–12 Months

Add AI-driven cashflow nudges.

Integrate contextual merchant offers.

Expand homepage as subscription upsell surface.

2+ Years

Zilch as the daily financial app — anchoring spend, save, borrow, and rewards in one hub.

Strategic moat against BNPL competitors.

Investor narrative: Zilch is a financial platform, not a credit tool.

Zilch “Do It For Our Customers” Award 2024

I received this award for outstanding contribution to improving customer experience at Zilch. It is one of only four company-wide awards given each year, each tied to a core value, and is voted for by employees with final approval from the C-suite.

The award recognised my leadership on initiatives that had direct customer impact:

Homepage redesign – simplified the first touchpoint of the app, reducing complexity and making it easier for customers to understand their options.

Design system creation – delivered a unified system in under a year, improving usability and consistency for 5 million customers.

Storefront redesign – shifted a cluttered, ad-heavy experience into a more customer-relevant shopping destination, with a focus on clarity and retailer diversity.

This work reflected Zilch’s core value of doing it for our customers by reducing friction, building trust, and aligning teams across product, marketing, and compliance. Receiving the award demonstrated not only the tangible customer impact of these projects, but also the recognition of peers and the executive team.